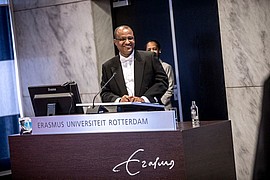

PhD Defence: Lemessa Bayissa Gobena

In his dissertation ‘Towards Integrating Antecedents of Voluntary Tax Compliance’ Lemessa Bayissa Gobena explores the integrative effect of social psychological factors among themselves as well as with economic deterrent factors in stimulating voluntary tax compliance.

Lemessa defended his dissertation in the Senate Hall at Erasmus University Rotterdam on Friday, 15 December 2017 at 15:30. His supervisor was <link people marius-van-dijke>Prof. Marius van Dijke and his co-supervisor was Dr Peter Verboon. Other members of the Doctoral Committee are <link people muel-kaptein>Prof. Muel Kaptein (EUR), <link people lucas-meijs>Prof. Lucas Meijs (EUR), Dr Jereon Stouten (University of Leuven).

About Lemessa Bayissa Gobena

Lemessa Bayissa Gobena was born on June 21, 1973 in Wollega, Ethiopia. He completed his high school in Gida Ayana Abiot Fire Senior Secondary School in Wollega, Ethiopia. He earned a two year diploma in Mathematics from Bahir Dar Teachers’ College in 1993. He graduated from Ethiopian Civil Service College with Bachelor of Arts degree in Accounting in 2001. He continued his study and graduated in Masters of Science in Accounting and Finance from Addis Ababa University in 2005. He started his PhD research in 2012 in Erasmus University Rotterdam under the supervision of professors Marius Van Dijke and Peter Verboon.

Lemessa’s research focuses on authorities’ fairness and their use of power in securing cooperative behaviors. His research interests are exploring how less democratic authorities could be viewed by their followers as fair and trustworthy in order to enjoy voluntary deference to their decisions and goals. His research has been published in a leading peer-reviewed journal, Journal of Economic Psychology.

Thesis Abstract

This thesis explores the integrative effect of social psychological factors among themselves as well as with economic deterrent factors in stimulating voluntary tax compliance, contributing to the tax compliance literature a theoretically relevant integrative approach that bridges between social psychological and economic deterrence approaches. It also contributes to the ecological validity of research on tax compliance behavior by comparing samples of two tax environments that are extremely unlike—one from a developing country (i.e., Ethiopia) and another from a developed country (i.e., the US).

Chapter 1 is an introductory chapter that seeks to introduce the thesis and summarize research on voluntary tax compliance, highlighting the need to integrate antecedents of voluntary tax compliance. Each of the three empirical chapters contributes to theoretical and empirical developments of the tax compliance literature. Chapter 2 explores the moderating roles of two (i.e., coercive and legitimate) types of power wielded by the tax authority in the relationship between procedural justice and voluntary tax compliance as mediated by (cognition-based) trust in the authority. This study finds support for the prediction that high (but not low) coercive and low (but not high) legitimate power of the tax authority moderate the positive relationship between procedural justice and voluntary tax compliance. Only procedural justice by legitimate power interaction has been mediated by (cognition-based) trust. Chapter 3 examines identification with the nation as a boundary condition to the interactive effect of procedural justice of and trust in the tax authority on voluntary tax compliance and finds support in two distinct samples for the prediction that the interactive effect (of procedural justice and trust) is significant among citizens who weakly (rather than strongly) identify with the nation. Chapter 4 explores legitimacy of the tax authority as a boundary condition to the interactive effect of procedural and distributive justice in stimulating voluntary tax compliance and finds support in two studies for the prediction that high (but not low) legitimate power moderates the interactive effect of procedural and distributive justice on voluntary tax compliance. Chapter 5 discusses in detail the empirical findings presented in this dissertation with emphasis on their theoretical as well as practical contributions and limitations.

Photos: Chris Gorzeman / Capital Images