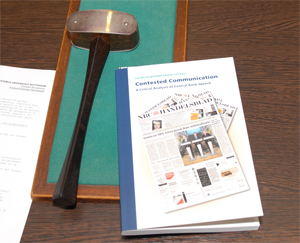

Contested Communication

Liesbeth Noordegraaf-Eelens has studied how central bank presidents struggle with the words they use in public. The aim of their communication is to manage our expectations and, as a result, manage our behaviour. They do so to ensure the stability of the financial system and the effectiveness of monetary policies. The underlying idea is that if everybody follows the advice of the central bank president, it will be beneficial to all.

Liesbeth Noordegraaf-Eelens has studied how central bank presidents struggle with the words they use in public. The aim of their communication is to manage our expectations and, as a result, manage our behaviour. They do so to ensure the stability of the financial system and the effectiveness of monetary policies. The underlying idea is that if everybody follows the advice of the central bank president, it will be beneficial to all.

This dissertation shows the paradoxical effect of using words instrumentally. By announcing their intention to manage expectations with words, central bank presidents greatly limit what they can say, because their words will be intensely scrutinised. This is true in normal times, and even more so in times of crisis. For the president, giving more information is not necessarily better than giving less, and silences can be just as dangerous as using words. In her dissertation, Noordegraaf-Elens intends to clarify this language game, both in normal times and in times of crisis.

Liesbeth Noordegraaf-Eelens defended her dissertation on October 19, 2010. Her promoters were Prof. Dr. Philip Hans Franses, Prof. Dr. Jos de Mul, and Prof. Dr. Dick van Dijk. Other members of the Doctoral Committee were Prof.dr. H.J. Achterhuis, Prof.dr. H.M. Prast, and Dr. F.J.H. Don.

About Liesbeth Noordegraaf-Eelens

Liesbeth Noordegraaf-Eelens (1973) studied economics and philosophy at Erasmus University Rotterdam. In 2002 she defended her philosophy thesis (cum laude), Het overspelige subject, which was later published De overspelige bankier (Klement 2004).

Several years later, she wrote Kinderen koop je in de hemel (Klement 2009) and Op naar de volgende crisis! (with Olav Velthuis, Klement 2009). In her research she works in an interdisciplinary fashion, linking philosophy to economics, with a particular interest for banks, bankers, risk, uncertainty and communication.

Since 1996, Liesbeth Noordegraaf-Eelens is a lecturer at the Erasmus School of Economics (ESE) of the Erasmus University. In 1997 she was elected ‘Teacher of the Year’ by students.

Since 2000, she is responsible for the ESE Bachelor Honours Class. Since 2009, she is also working as a senior researcher and program manager at the Netherlands School for Public Administration (NSOB) in The Hague. Among other things, she studies trust in public domains, as well as coping with (potential) institutional crisis.

Liesbeth Noordegraaf-Eelens is married and has four children.

Abstract

The more important words become, the more difficult it is to say things. This is the central message of this study on the communication by central bank presidents. Since the end of the twentieth century, central bank presidents see communication as an important means to influence expectations of their publics. In this book, we show how this happens: central bank presidents rely on fixed settings, speak at specified moments, and repeat certain words. Press conferences clearly illustrate this. This strict approach to communication, however, focuses attention on slips of the tongue and (speculative) interpretations of statements, made at planned or unplanned moments.

The more important words become, the more difficult it is to say things. This is the central message of this study on the communication by central bank presidents. Since the end of the twentieth century, central bank presidents see communication as an important means to influence expectations of their publics. In this book, we show how this happens: central bank presidents rely on fixed settings, speak at specified moments, and repeat certain words. Press conferences clearly illustrate this. This strict approach to communication, however, focuses attention on slips of the tongue and (speculative) interpretations of statements, made at planned or unplanned moments.

In times of crisis, these communication ‘disturbances’ are enlarged – communication becomes severely contested. A crisis casts doubt on the legitimacy of authorities. Must we still listen to central bank presidents? Do central bank presidents say what they really think? A detailed analysis of statements by central bank presidents on the British Northern Rock and the Dutch/Belgium Fortis banks shows how central bank presidents communicate by ‘trial and error’. Everything they say can be used against them. Remaining silent is impossible, as silences can be dangerous as well.

By combining philosophical and economic insights, this study not only sheds light on how communication in financial markets evolves, it also explains why communication can become contested. Instead of an instrumental understanding and usage of communication, this dissertation stresses the relevance of a critical-pragmatic perspective on financial communication.