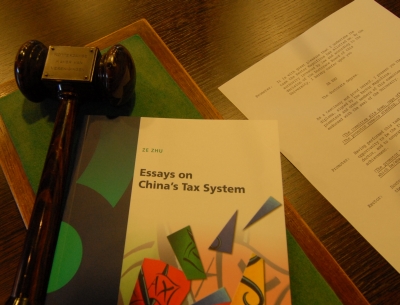

Ze Zhu defended PhD thesis on Chinese tax system

On September 4, Ze Zhu defended his PhD thesis entitled “Essays on China’s Tax System”. His promotors are <link people barbara-krug _blank>Prof.dr.Barbara Krug, Professor of Economics of Governance, and <link people george-hendrikse _blank>Prof.dr.George W.J. Hendrikse, Professor of Economics of Organisation, both from RSM Erasmus University. His dissertation intends to put forth a theoretical framework and empirical methods of taxation research, applicable to the non-democratic background in China and intends to contribute to the wider application of the theory of New Institutional Economics.

On September 4, Ze Zhu defended his PhD thesis entitled “Essays on China’s Tax System”. His promotors are <link people barbara-krug _blank>Prof.dr.Barbara Krug, Professor of Economics of Governance, and <link people george-hendrikse _blank>Prof.dr.George W.J. Hendrikse, Professor of Economics of Organisation, both from RSM Erasmus University. His dissertation intends to put forth a theoretical framework and empirical methods of taxation research, applicable to the non-democratic background in China and intends to contribute to the wider application of the theory of New Institutional Economics.

Ze Zhu was born on January 1st, 1978, in Shangyu, Zhejiang province in China. After obtaining his Bachelor of Science in Business Administration in 1998 and Master of Science in Management Science and Engineering in 2001 at Zhejiang University, he worked at China Mobile Communications. He became a Ph.D. candidate at the Department of Organisation and Personnel Management, RSM Erasmus University in 2003. He visited the University of New South Wales, Sydney, for research in 2005. His current research interests include fiscal decentralisation, tax competition and business strategy. Zhu published a book chapter and several Chinese journal articles. He also presented papers at international conferences, such as the Annual Conference of International Society for New Institutional Economics, the Annual Meeting of European Public Choice Society and the Conference of the Asia Academy of Management. After his defense, he will work at DSM in Sittard, the Netherlands.

Abstract

The tax system is one of the best starting points for investigating China’s transitional course because the transformation of a society always involves rapid changes in its old fiscal regime.

Considering the central government, local governments and firms as three major players, this dissertation shows that interactions between them have lead to the emergence of China’s unique central-local dual-track tax system. Indeed, the central government mobilises local governments by fiscal decentralisation, thus resulting in growing local autonomy which drives them to maximising local tax revenues. Local governments compete for mobile tax bases (firms) by manipulating local tax policies. Therefore, in contrast to a formal and standardised national tax system overseen by the central government, informal and flexible local tax systems are operated by local governments. This results in two completely different tax systems that run in parallel.

This dissertation consists of four essays. The first essay systematically analyses the evolution history and status quo of China’s tax system, which illustrates that the formal and informal interaction between the central government, local governments and firms shapes the institution building process of China’s tax system.

The second essay, then, examines the interaction between the central government and local governments in fiscal decentralisation and finds that it curtails the expansion of government size.

The third essay models the interaction between the local governments and firms by a bargaining game in which a firm employs an exit and voice strategy to bargain with a local government for preferential tax treatments and thus explains the diversity of local tax systems.

The fourth essay models changes of the tax system as a result of interactions between the above three players under various economic, political and social constraints; the changes results in a general equilibrium in which efficiency, power and legitimacy are balanced.

More Information

Pictures of the Defense

Full text of the Dissertation