Where do I list my company?

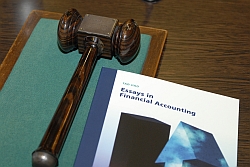

On June 12, Tao Jiao has defended her PhD thesis entitled “<link erim events _blank>Essays in Financial Accounting”. Her thesis is devoted to investigate the interaction between the quality of accounting information and the external environment where firms operate, such as stock exchange and stock market. The quality of accounting information is the key for investors to make their investment decisions and to evaluate the performance of managers.

On June 12, Tao Jiao has defended her PhD thesis entitled “<link erim events _blank>Essays in Financial Accounting”. Her thesis is devoted to investigate the interaction between the quality of accounting information and the external environment where firms operate, such as stock exchange and stock market. The quality of accounting information is the key for investors to make their investment decisions and to evaluate the performance of managers.

One of Jiao’s practical findings is that after the adoption of IFRS (International Financial Reporting Standards), the quality of analyst forecasts has been increased. Investors can get better insight of firms' performance by referring to analyst forecasts. Jiao also finds that the regulatory body of stock markets and investors may need to be more cautious about firms' earnings management behaviour when the industry is booming as during such time firms benefit more by managing earnings. Next, she finds that firms' IPO failure rate is related to their listing choice. A newly established stock market is relatively weaker in face of big crises so that listing on newly established markets may decrease the survival rate of listed firms. Therefore, firms need to be careful in choosing the stock exchange to list on.

About Tao Jiao:

Tao Jiao was born in Yinchuan, China on June 27, 1979. She obtained her B.A. degree from Shanghai Jiao Tong University (Shanghai, China) in 2001 with a major in industrial foreign trade. In 2004, she obtained her MSc degree in finance from Shanghai Jiao Tong University. In the same year, she joined the Department of Finance and Accounting, Rotterdam School of Management, Erasmus University, and the ERIM PhD program. Her research focuses on corporate governance and financial accounting. She has presented her work at the European Accounting Association (EAA) annual conference and has served as a discussant in the Executive Compensation Workshop organized by University of Stirling. At Erasmus, she has taught several courses, including Corporate Finance, Financial Accounting and International Financial Management. She has also supervised a number of graduate students with their master’s theses. From January 2008 to January 2009, she worked as a valuation consultant at Duff and Phelps BV, Amsterdam, the Netherlands.

Abstract:

Abstract:

This dissertation contributes to the literature on the quality of accounting information by investigating its interaction with institutional factors (their external environment) in which firms operate, such as industry and stock exchange. The research topics of this dissertation include the motivation of earnings management (Chapter 2), the consequence of accounting frauds on the failure rate of IPO firms (Chapter 3) and the effectiveness of actions taken by standard setters to improve the quality of accounting information (Chapter 4). Chapter 2 focuses on firms’ industry environment and investigates whether industry valuation impacts management’s decision to manage earnings. Chapter 3 has been devoted to examine the consequence of large scale earnings management or accounting scandals on the firm’s external environment. Chapter 4 examines whether the uniform adoption of IFRS by EU countries in 2005 improves the quality of accounting information by investigating the changes in the quality of analyst forecasts.

More Information

Pictures of the Event

Full Text of the Dissertation