| Customers face difficulties dealing with interest rates. Not only are they generally unable to correctly estimate the number of months it takes to settle a loan, they also systematically underestimate this number of months of payments.

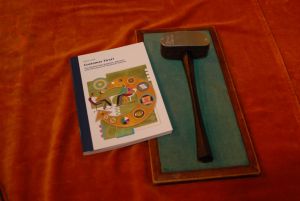

In her dissertation entitled Customer First? The Relationship between Advisors and Consumers of Financial Products, PhD candidate Anita Vlam argues that a simple tool for consumers should be available to help the consumers obtaining information on interest rates. To enhance decision making, many consumers turn to a financial advisor. Moreover she finds evidence that a higher educated customer is better prepared and spends more effort to understand the various features of financial products. Education of the customer plays an important role in understanding the advice and financial information. Results of her study further show that advisors are convinced that they advice in the customer’s benefit. Vlam says: “Policy makers believe that disclosure of fee improves the quality of financial advice and the relationship between a financial advisor and a customer. My research does not support this notion”.

Anita Vlam defended her dissertation on December 1 2011. Her promoter was <link people philip-hans-franses _blank>Prof.dr. Ph.H.B.F. Franses. Other members of the Doctoral Committee were Prof.dr. I.J.M. Arnold, Prof.dr. S.G. van der Lecq, and Prof.dr. W.F. van Raaij. |

About Anita Vlam

Anita Vlam (1964) studied economics at Erasmus University Rotterdam and received her doctoral degree in 1989. After her graduation she worked for about twenty years in process management, as a team manager mortgages and senior product manager mortgages at several financial services companies. She participated in the Mature Talent Program of the Erasmus School of Economics to do research and write a PhD dissertation since 2008. Her research interests include financial literacy, financial services, consumer behavior, and relationship management. Anita Vlam is married and has three children. Anita Vlam (1964) studied economics at Erasmus University Rotterdam and received her doctoral degree in 1989. After her graduation she worked for about twenty years in process management, as a team manager mortgages and senior product manager mortgages at several financial services companies. She participated in the Mature Talent Program of the Erasmus School of Economics to do research and write a PhD dissertation since 2008. Her research interests include financial literacy, financial services, consumer behavior, and relationship management. Anita Vlam is married and has three children.

Abstract of Customer First? The Relationship between Advisors and Consumers of Financial Products

Customer First is an important issue of the recently introduced banking code in the Netherlands. It mainly concerns customer satisfaction and it is aimed at regaining trust of customers. Interestingly, the code does not address the urgency of improving customers’ financial literacy and their ability to make sound financial decisions, given that they consult a financial advisor. This dissertation specifically considers these two topics.

In the first chapters empirical results about the sheer size of consumer debts and the difficulties that consumers have with interest rate computations are presented. With newly acquired data, it is documented that the willingness to purchase on credit reduces when the total amount involved is mentioned explicitly. As consumers apparently need help, many turn to financial advisors. The second part of this dissertation deals with an extensive survey amongst financial advisors and their customers. This unique database could be compiled with the help of two Netherlands-based financial institutions. The study addresses the perceived expertise of the advisor and the advisee, the satisfaction levels and the relevance of the disclosure of the advisor’s fee. The answers of advisors and consumers are contrasted and a substantial difference in opinions about the same topics is documented. |

Anita Vlam (1964) studied economics at Erasmus University Rotterdam and received her doctoral degree in 1989. After her graduation she worked for about twenty years in process management, as a team manager mortgages and senior product manager mortgages at several financial services companies. She participated in the Mature Talent Program of the Erasmus School of Economics to do research and write a PhD dissertation since 2008. Her research interests include financial literacy, financial services, consumer behavior, and relationship management. Anita Vlam is married and has three children.

Anita Vlam (1964) studied economics at Erasmus University Rotterdam and received her doctoral degree in 1989. After her graduation she worked for about twenty years in process management, as a team manager mortgages and senior product manager mortgages at several financial services companies. She participated in the Mature Talent Program of the Erasmus School of Economics to do research and write a PhD dissertation since 2008. Her research interests include financial literacy, financial services, consumer behavior, and relationship management. Anita Vlam is married and has three children.