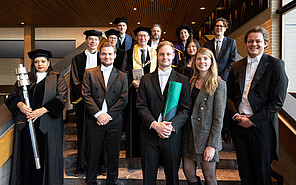

PhD Defence Jeroen Koenraadt

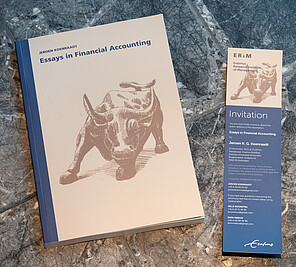

In his dissertation 'Essays in Financial Accounting', Jeroen Koenraadt evaluated the current financial disclosure mechanisms in place, finding sub-optimal levels of quality brought forward through market frictions and an overly complex process. He explored ways financial disclosures can be improved and how regulation and discovery is perceived. His research contributes to a profound field that is constantly changing and under scrutiny. Jeroen successfully defended his dissertation on Friday, 25 November 2022 at 13:00. His supervisors were Dr P.Y.E. (Edith) Leung (ESE), and Prof. J.P.M. (Jeroen) Suijs (ESE). The members of his doctoral committee were Prof. E. (Erik) Peek (RSM), Prof.A.M. (Ane) Tamayo (LSE) and Prof. D. (David) Veenman (UvA).

About Jeroen Koenraadt

Jeroen Koenraadt was born on April 26th, 1994 in Enschede, The Netherlands. He obtained his Bachelor's degree in Economics and Business Economics from the Erasmus University Rotterdam in 2016. In 2017, Jeroen completed his Master's studies cum laude in Accounting, Auditing and Control at the Erasmus University Rotterdam. He subsequently joined the Erasmus Research Institute of Management of the Erasmus University Rotterdam to begin his doctoral studies at the department of Accounting, Auditing and Control. His research interests include market participants’ use of financial information, how regulation shapes financial information, and how information intermediaries analyze and disseminate information to level the playing field among investors. Jeroen visited the Department of Accounting at Columbia Business School in New York from September 2019 till April 2020. Since September 2022, he has been appointed as Assistant Professor of Accounting at the London School of Economics and Political Science.

Thesis Abstract

Disclosure of financial information by firms is essential for the well-functioning capital markets, but there are several market frictions in the supply and demand of disclosure, and the different aspects of the complex disclosure process, that lead to sub-optimal levels in quantity and quality of disclosure. This dissertation explores three attempts of regulators, gatekeepers, and intermediaries in the financial information environment to address these frictions to improve capital markets. The first part of this dissertation investigates how investors perceive regulation that requires crypto token firms to disclose information, and shows that they perceive it as costly, or burdensome, but less so for crypto token companies that are already transparent. The second part of this dissertation investigates the introduction of the security markets regulator in the U.S. in 1934 and finds a very limited impact of a rule that forces public firms to get an audit on trust in capital markets. The last part of this dissertation finds that capital markets are better off when a platform that pays people for analysing stocks starts paying people more when they analyse a firm that has not received a lot of attention before. Overall, the three studies that form this dissertation build on the understanding of the constantly changing information environment and the role of regulators, gatekeepers, and intermediaries in addressing market frictions that lead to sub-optimal levels of credible and financial information, negatively affecting capital markets.

Click Here To View Jeroen's PhD Defence Photo's

Photos: Michelle Muus / Michelle Muus Fotografie